Last Updated on February 12, 2022 at 6:25 pm

These are the freefincal handpicked list of mutual funds for July-Sep 2021. New and old investors can use it according to their specific needs. The list is called “PlumbLine” and was started in Sep 2017 for beginners to accompany the freefincal robo advisory template.

Most important! Plumbline is a mix of my opinions + skin in the game (where I invest) + quantitative picks (performance-based). It is not meant to satisfy everyone! It is intended to match up to my integrity.

The reader new to plumbline should read the following two sections carefully before proceeding to the fund names. Note for those familiar with the list: I recently asked for feedback in the FB group Asan Ideas for Wealth. I find that readers seem to want fund recommendations in every possible category.

This is not the aim of the list. Here, the objective is to identify “some” funds for every possible investment duration as part of a diversified portfolio. If you want to choose funds in categories of your choices, you can either use our monthly equity mutual fund, debt mutual fund or index fund screeners.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

If you want to select equity mutual funds by consistent performance alone or if you want to choose debt funds by the quality of their portfolio, then head over to the screeners linked above.

The debt fund screener is a new addition and primarily driven by all requests for fund recommendations in the PSU & Banking funds, corporate bond, medium duration category. People assume it is “safe” despite clearly stating risks when a debt fund recommendation is made. So it is better that I offer a way to screen than recommend one. The debt fund screener will also serve as a way to learn and understand debt funds.

Is Plumbline even relevant anymore? Why not just use index funds? Plumbline was/is only as relevant as you make it. Active or passive investing ultimately boils down to a choice. What you do is up to you. Since I have no conflict of interest, I see no harm in providing both choices to the reader. So plumbline caters to both passive and active investors, both debt and equity investors.

That said, for a young learner, or for anyone who is just starting in equity MFs, passive investing is the simplest option: I am 22 and can invest 50K a month but am confused about how to start. You have two choices, take my word for it (and the evidence I am offering) or live and learn and become a grumpy uncle like me.

What is Plumbline, and how should I use it?

A plumbline is an alignment device used to fix the vertical or the horizontal. This list is called plumbline to indicate the need for fund choices to align with specific requirements.

1: PlumbLine is a boring list of mutual funds updated every quarter. There are plenty of good mutual funds that are not part of Plumbline. If your funds are different, you are probably better off. Do not worry about it.

2: Do not use PlumbLine for confirmation of your choices! PlumbLine is meant for young earners and first-time investors after they have used the freefincal robo advisory template.

3: If tomorrow the funds in the list change, you will have to take a call on what you need to do, based on the fund performance from the date in which you invested. I cannot help you here other than talk about how to review.

4: This is a handpicked list and will be subject to my biases. I invest with a bias to get things done and analyze without bias to present facts. So please bear this distinction in mind.

5: This is a goal-based list and not a category-based list. That is, you will not find one fund per category. It will be one-fund per need (goal and risk-taking ability)

Disclaimer: On its own, this list has no meaning, and unless you can look at it from the right perspective and context, it will not help you. The hope is that the robo template will provide such a perspective that it still has to be processed and interpreted by you. Finally, I am only human and more than capable of making mistakes.

Also, I am a below average investor and fund picker or analyzer. I am not a fan of looking into the fund portfolio. I prefer funds with a narrow investment mandate. I am sure you will agree that most of the picks are lame and obvious .and that this list is a no-brainer and nothing special. If the funds here stop performing in the future or have credit defaults issues, all I can do is modify the list (if required). Note: All statements about risk being low or high are relative to other types of funds and not absolute.

I WILL NOT BE IN ANY WAY RESPONSIBLE FOR YOUR INVESTMENT CHOICES, CAPITAL GAINS OR LOSSES. If a PlumbLIne fund is present in your portfolio, it means nothing. If none of your funds is present in the PlumbLine list, it means nothing. MUTUAL FUNDS (and mutual fund recommendations) ARE SUBJECT TO IGNORANCE RISKS AND MARKET RISKS. PLEASE READ AND UNDERSTAND ALL SCHEME RELATED DOCUMENTS BEFORE INVESTING.

FAQ on Plumbline

1. Why are X, Y or Z funds not part of Plumbline —> Plumbline is my list. Don’t expect me to make a list that matches your expectations.

2. The funds you have listed are not even 4-star funds —> I don’t care. Star ratings are injurious to your mental and fiscal health. Comparisons are injurious to peace of mind, and Plumbline is just plain bad.

3. Plumbline does not feature the top funds from your monthly screener —> Yeah, because I do not always consult it. Plumbline is a qualitative + quantitative assessment of a funds investment strategy, mandate and performance.

4. I find your list is biased and partial to certain funds and certain AMCs –> Okay then, thank you for not using it.

5. If you are a new mutual fund investor, download this Free e-book: Mutual Fund FAQ 100 essential Q & A for new investors!

Liquid Fund

- Investment Duration Few months and above

- Fund name Quantum Liquid fund Direct Plan-Growth Option, Parag Parikh Liquid Fund

- Nature Conservative; these funds invest in short-term bonds up to 91 days in maturity.

- Interest rate risk: low (can give losses if RBI rate is suddenly increased by a huge amount, but will recover in days – the lastest such event was in Mar 2020).

- Credit risk: low

- Suitable for Use for parking money

- Returns a bit more than SB account

- Caveats: Debt fund portfolios change each month; while both funds tend to avoid credit risk, investors can occasionally check the credit quality of the portfolio

- Disclosure: Invested in quantum liquid for emergencies.

- Also, see: Can I use liquid funds for long-term goals with equity MFs?

Equity Arbitrage

- Duration 1Y and above (never use for shorter-term)

- Fund name ICICI Equity Arbitrage Fund-Direct Plan Growth Option.

- Nature: These are hybrid funds now! They can invest up to 35% in bonds! The majority of the portfolio (65% plus) is arbitrage like “cash and carry arbitrage” (linked below). The funds have debt fund-like volatility by construction. Volatile for less than a year. Quarterly returns can be negative. Volatile when the market is turbulent.

- Interest rate risk: low Applicable to bond part of the portfolio.

- Credit risk low (applicable to bond part of the portfolio), but credit events are certainly possible. You can use our debt fund screener to screen for bond quality in these funds.

- Warning: After the SEBI recategorization, arbitrage funds only need to hold 65% in derivatives. Rest are in bonds. So these funds can be subject to credit and interest rate risks.

- Other risks Uncertain periods like after a crash could reduce arbitrage opportunities and returns. If you choose the investment duration right, the main risk will be the fund delivering a lower than expected return. So expect less!

- Suitable for parking money, medium-term goals and generating income. See: Generating tax-free income from arbitrage mutual funds.

- Returns Expect about 6% ish pre-tax.

- Con: You need to understand how the product work. Try this How Arbitrage Mutual Funds Work: A simple introduction.

- Disclosure: ICICI Equity Arbitrage is part of the debt portfolio for my son’s education goal. My wife also separately uses it as part of our emergency fund.

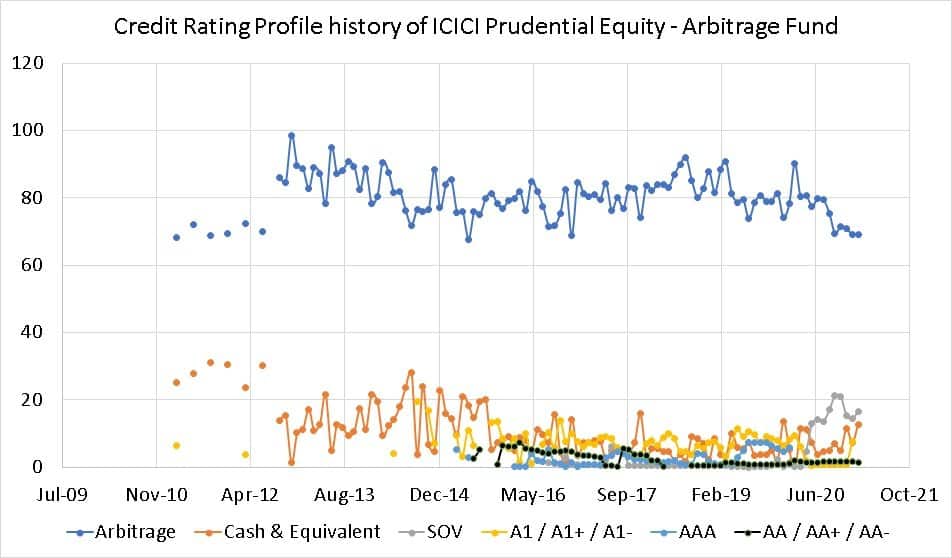

This is the credit rating profile history of ICICI Arbitrage. You will get a spot of AA bonds. If that bothers you, then you not should invest in this.

Money market/ Ultra Short-term

- Duration 1Y and above

- Funds: ICICI Pru Money Market Fund See Review: When & how to use it. HDFC Money Market Fund.

- Franklin India Savings Fund-Direct Plan-Growth was earlier part of the list. There is nothing wrong with it. I have removed it only because very few would be comfortable with Franklin AMC now. The Franklin fund has stayed afloat despite a 77% drop in AUM from November 2019 (Rs. 5071 Crores to Rs. 1143 Crores in May 2021). This is a sign that at least the money market segment of the Indian debt market is reasonably liquid.

- Nature Conservative but expect day to day NAV ups and downs due to demand-supply fluctuations. These funds invest in the money market – where cash is the commodity. The bonds are short-term in nature (low-interest rate risk);

- Credit risk is relatively low, but defaults are possible.

- Interest rate risk: low (due to investors pulling out from the debt market, these funds fell about 1% from 11-25th March, but when RBI removed excess liquidity by buying bonds and lowering rates by March 27th 2020)

- Suitable for saving money, generating income, for short-medium term goals

- Returns Expect FD-like returns (lower tax if you want for 3Y)

- Disclosure: Not invested as it is not necessary for my needs.

Ten-year Gilt

- Duration Strictly long term: More than 15Y, preferably much longer with proper asset allocation and periodic rebalancing. Only for those comfortable with severe NAV fluctuations (no risk, no extra reward!).

- Fund name SBI Magnum Constant Maturity Fund. ICICI Prudential Constant Maturity Gilt Fund – Direct Plan

- Read Review: A Debt Fund With Low Credit Risk for long term goals!

- Nature Invests in close to 10Y government bonds and some low-risk short term bonds

- interest rate risk: very high

- Credit risk low!

- Why? If you wish to minimize credit risk events but are willing to take on interest rate risk and willing to rebalance the portfolio at least once a year, actively.

- Suitable for Use as a debt component for very long-term goals; however, one cannot stay invested in these funds right before we redeem!

- Returns Should be close to long term FD average (but can suffer if there a long period of no rate cut or rate hike). NAV can gradually fall over months or can suddenly shoot up or down.

- Disclosure: Not invested as it is unnecessary for my needs (My NPS has a good deal of gilts). See Ten years of investing in the NPS: Performance report.

- Also, see: Can we invest via SIP in gilt mutual funds for the long term? and

- Can we get better returns by timing entry & exit from gilt mutual funds?

Gilt Long-Term

Many readers have asked why a gilt fund can invest in GOI bonds across maturity is not being recommended. Such a fund would be susceptible to fund manager risk if they incorrectly read the market supply and demand. However, if such a risk is acceptable to you, you can consider funds like (in alphabetical order)

- HDFC Gilt Fund Direct Plan-Growth Option

- ICICI Pru Gilt Fund Direct Plan-Growth Option

- SBI Gilt Fund Direct Plan-Growth Option

- Each fund in this category would have its own style. So it is important investors study the investment style history from factsheets before investing. See: How to choose a gilt mutual fund.

- Suitable only for long-term goals. For first-time investors, 10Y or more. The NAV will fluctuate pretty rapidly here, too but a bit less than the 10Y gilt category.

- Disclosure: I started investing in the ICICI Gilt fund recently. See: Why I partially switched from ICICI Multi-Asset Fund to ICICI Gilt Fund.

“International” Equity

Personally, I am happy with the effective 10% international equity exposure I get from Parag Parikh Long-term equity fund. Most people who want “international equity” for “diversification” are simply chasing a bunch of US stocks’ past performance.

Including another asset class in the portfolio (international equity is another asset class because of currency risks) requires regular rebalancing regardless of tax. If you put a gun to my head and want a fund in this category…

- Motilal Oswal S&P 500 Index Fund Direct Plan-Growth Option See: What return can I expect from this?

- Avoid all other ETFs, fund of funds investing in ETFs or actively managed funds domiciled in Luxembourg or the Cayman Islands!! To understand better, check out the reviews linked below.

- SBI International Access ‐ US Equity FoF Review

- Kotak International REIT FOF: What return can I get from this? Ok, this is a REIT, but hey, I got a chance to plug it!

- Franklin India Feeder: Franklin U.S. Opportunities Fund Review

- PGIM India Global Equity Opportunities Fund Review: Should You Invest?

- Axis Global Equity Alpha Fund of Fund Review: Should You Invest?

- Axis Global Innovation Fund of Fund Review

Equity Tax planning

You would initially need about 50-60% of equity for a goal that is more than ten years away. If you choose the new tax regime or if you can accommodate Rs. 1.5 lakh of investments in the 50-40% fixed income component of the portfolio, ELSS mutual funds are unnecessary!

- Duration Use only for long-term goals with proper asset allocation. The following recommendations (except the Parag Parikh fund) are purely quantitative based on consistent performance.

- Fund names (in alphabetical order) Aditya Birla Sun Life Tax Relief ’96 – Growth – Direct Plan or DSP Tax Saver Fund-Direct Plan-Growth Option or Mirae Tax Saver Fund Direct-Plan Growth Option orParag Parikh Tax Saver Fund*

- * This is a relatively new fund with a similar investment style to Parag Parikh Long Term Equity Fund. Also, see ELSS Mutual Funds: Seven Consistent Performers.

- Suitable for Use only if you have a proper asset allocation and cannot exhaust 80C with your expenses and fixed income instruments. Read more: Making the best use of section 80C for tax saving: an example.

- Disclosure: Not invested as it is not necessary for my personal situation.

Hybrid Funds (equity-oriented)

- Duration Treat all such funds as pure equity funds, so strictly long-term. Use the robo template for allocation.

- All the following funds (in alphabetical order) have a reasonably consistent track record against the Crisil Hybrid 65:35 Index.

- Canara Robeco Equity Hybrid Fund – Direct Plan-Growth

- HDFC Hybrid Equity fund Direct plan growth option

- ICICI Equity & Debt fund

- Mirae Asset Hybrid Equity Fund

- SBI Equity Hybrid Fund Direct Plan-Growth option

- Risk Only a bit lower than diversified equity funds, so treat them as pure equity.

- Why? The HDFC fund is neither inconspicuous nor a star but a consistent performer with good downside protection.

- ICICI fund has been included because of this review: ICICI Prudential Equity & Debt Fund (ICICI Balanced) Performance Review

- Also, see Three excellent aggressive hybrid mutual fund performers.

- Disclosure: I am invested in HDFC Hybrid Equity for retirement

- Those who are confused about choosing between active and passive funds can choose hybrid funds (agg hybrid or balanced advantage) – at the very least, they get a bit lower volatility.

- Fund name ICICI Multi-Asset Fund

- Nature equity-oriented hybrid fund with a little gold

- Disclosure: Use this for my son’s education goal.

- If used as a portfolio core holding, this provides a small exposure to gold in a tax-efficient manner.

- Fund name ICICI Balanced Advantage Fund Direct plan Growth Option

- Nature: Direct equity allocation will be tactically varied. The volatility is a bit lower than the above funds but should be treated as “pure equity.”

Flexi-cap/ Large midcap/Multi-cap

- Duration Strictly long-term with proper asset allocation. Use the robo template for allocation.

- Fund name Parag Parikh Long Term Equity Fund

- Why? Excellent downside protection resulting in a consistent performance. Who should use it? Only those with low expectations, patience. Not suitable for star rating fans and daily portfolio “trackers.”

- Disclosure: I invest in Parag Parikh Long Term Equity Fund for my retirement and Quantum Long Term Equity & HDFC Hybrid Equity.

- Risk: There is too much reliance on the fund manager. All funds go through ups and downs in performance. This fund is too young to have seen a dip in performance. It will, only a matter of time.

- Warning: The fund’s AUM has swelled up quite a bit – the AUM of Parag Parikh Flexi Cap Fund grew by 147% in 2020! Whether this affects the performance or not immediately, it certainly limits the ability of the fund manager to churn (whether he wants to or not is another matter). So do not expect the past performance of this fund to repeat in future!

- Note about Quantum Long Term Equity: The fund was earlier listed in this category. After going through an extended period of underperformance because of market imbalance, it sees a resurgence now. Few investors will have the patience to wait, so it has been removed from this listing but not from my portfolio. With the market imbalance almost removed, I expect funds like QLTE and ICICI Val Discovery to do better in the future. You can see an update here: How my retirement portfolio has performed in 2020: personal finance audit.

Index funds (large cap top 50/30)

- Duration Strictly long-term with proper asset allocation. Use the robo template for allocation.

- UTI Nifty Index Fund-Direct Plan-Growth Option or

- HDFC Sensex Index Fund-Direct Plan-Growth Option or

- HDFC Index Fund-NIFTY 50 Plan(G)-Direct Plan

- Who should use it? If you wish to adopt a passive investing strategy (eliminate fund manager risks) and wish to track a less volatile large-cap index.

- Index funds do not provide any downside protection (fall lower than index) or upside performance (move up higher than index). Whether this is important or not is up to you. I wish to take a more balanced approach to passive investing than act like a Boglehead zombie who is supremely sure that all active funds will fail to beat the index. No, they do not, not even in the US, not even today: 582 US Large cap funds outperformed S&P 500 over the last 10 years.

- Active funds do provide downside protection typically more often than they beat the index.

Please note that to assume downside protection is useless if it does not result in more return is hindsight bias. Risk is in the journey. Returns are always in hindsight.

Index Fund Blend (large + midcap)- higher risk

- Duration Strictly long-term with proper asset allocation. Use the robo template for allocation. 50% Nifty 50 + 50% Nifty Next 50

- Fund name (NIfty 50) As above.

- Fund name (NIfty Next 50) UTI Nifty next 50 direct plan growth option or ICICI Nifty Next 50 Direct Plan-Growth Option See: What is the best way to invest in Nifty Next 50 Index?

- That is, 50% of a Nifty (or Sensex) fund and 50% of a Nifty Next 50 fund (let us call this the Nifty Blend 50:50).

- Who should use it? Only those who appreciate Index investing benefits and will not chase after stars or compare with peers. See: Will large-cap mutual funds struggle to beat the Nifty 100 Equal Weight Index?

- Warning 1: The Nifty Next 50 can be an extremely frustrating index to hold compared to the Nifty. By adding 50% of Nifty Next 50, you guarantee more risk, not more returns – that may or may not happen “over the long term”.

- Warning 2: The volatility of Nifty Next 50 has considerably reduced over the years. Therefore do not expect double-digit returns from Nifty Next 50 index funds!

- NIfty Next 50 does not suffer from concentration risk like the Nifty or the Sensex. But this may not result in lower volatility or more returns!

Index Fund Blend (large + midcap)- lower risk

- Duration Strictly long-term with proper asset allocation. Use the robo template for allocation. 70–80% of Nifty 50 + 30-20% of Nifty Next 50

- Fund names: As above.

- That is, 70% (or 80%) of a Nifty (or Sensex) fund and 30% (or 20%) of a Nifty Next 50 fund (let us call this the Nifty Blend 70:30 or 80:20).

- Who should use it? Only those who appreciate Index investing benefits and will not chase after stars or compare with peers. See: Will large-cap mutual funds struggle to beat the Nifty 100 Equal Weight Index?

- Those who wish to invest in less than 25% of Nifty Next 50 can consider Axis Nifty 100 Index fund. Read the review here: Axis Nifty 100 Index Fund Impressive AUM but is it expensive?

- Also, see: Can I use these two index funds for retirement instead of Nifty, Nifty Next 50?

- Why? See: Combine Nifty; Nifty Next 50 funds to create large, mid cap index portfolios.

- Why no active funds? Because Only Five Large Cap funds have comfortably beat Nifty 100 and there is no point in using an active large cap fund anymore

Midcap & Small Cap

We have never recommended investing in smallcap funds. It has become difficult to recommend midcap funds because very few manage to beat the Nifty Next 50. The little exposure to these categories from a flexi-cap or aggressive hybrid fund is enough for most investors IMO. If you wish to choose consistent performers among active mid cap or small cap funds, you can consult the latest equity mutual fund screener.

- Why use NIfty Next 50 instead of midcap or smallcap funds.

- If you wish to buy a mid cap fund …

- Avoid Midcap (or small cap) Index funds. See: Not all index funds are the same! Beyond top 100 stocks tracking errors are huge!

- Duration Strictly long-term with proper asset allocation. Use the robo template for allocation. Do not exceed 40-50% within the equity portion. That is, your total midcap + smallcap allocation should not exceed 40-50% of your total equity allocation. For eg: 60% large cap + 30% midcap + 10% small cap (if you must!).

- In small cap funds, additional tactical buying and selling may be necessary for lower risk (not higher returns): A tool for tactical buying and selling using moving averages. Do not blindly invest via SIP in the case of small cap funds: Do not use SIPs for Small Cap Mutual Funds: Try this instead!

Closing Remarks

The fund names mentioned above are of little use if your investments are not aligned to goals and if you do not know how to evaluate them in a structured manner. We recommend that investors first identify their goals, choose a suitable asset allocation plan, and consider investments. Here is an example: How Avadhoot Joshi evaluates his investment portfolio.

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)